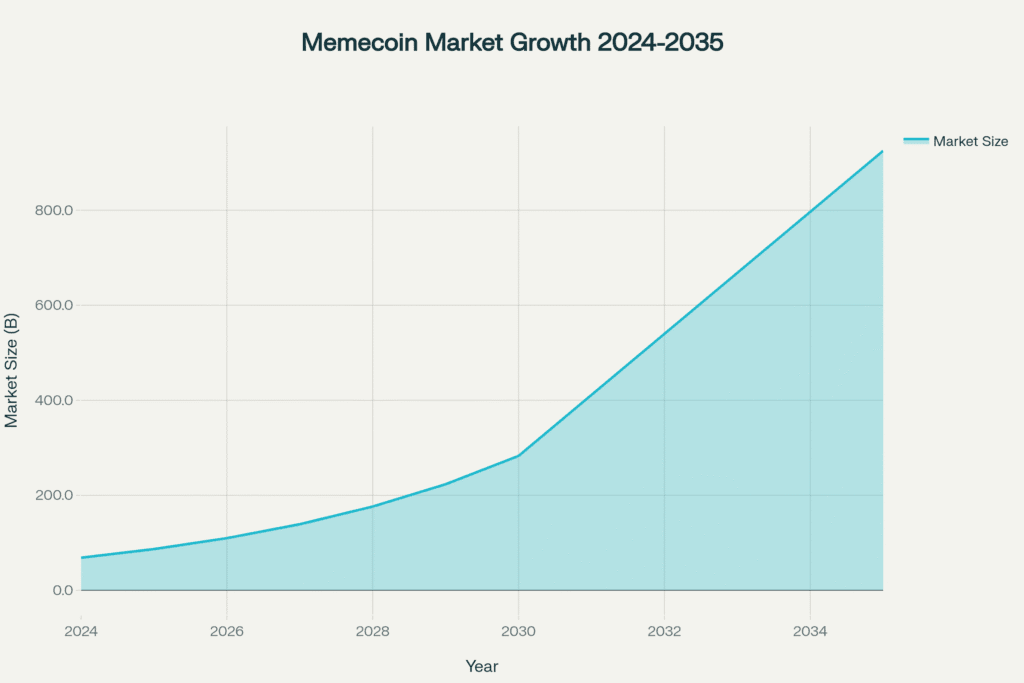

The memecoin revolution is here, and it’s bigger than ever. With the market exploding from $68.5 billion in 2024 to a projected $925.2 billion by 2035, memecoins represent one of the most lucrative opportunities in cryptocurrency today. This comprehensive guide reveals the proven strategies, tools, and insider knowledge you need to profit from this explosive market.

Memecoin Market Explosive Growth: From $68.5B in 2024 to $925.2B by 2035

The Memecoin Market Opportunity

Memecoins have evolved far beyond simple internet jokes into serious investment vehicles generating life-changing returns. The sector experienced an astounding 833% growth in 2024, with early investors in projects like Dogecoin and Shiba Inu seeing returns exceeding 46,000,000%. What makes 2025 particularly exciting is that we’re entering the most bullish period in four years, with September through December expected to deliver unprecedented altcoin season performance.

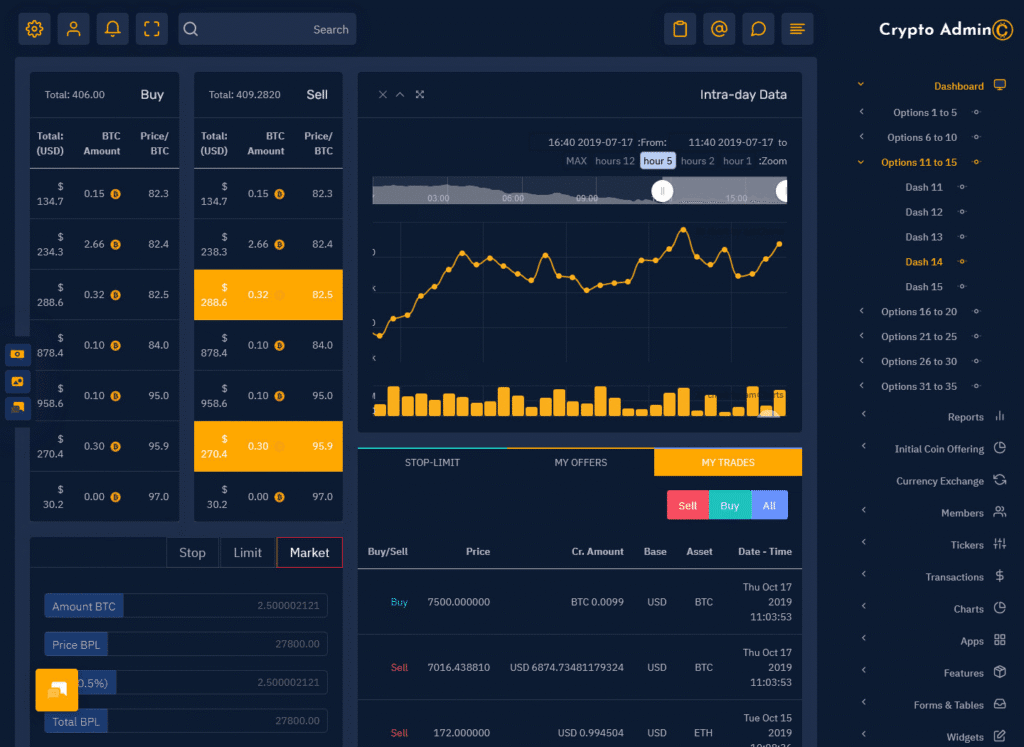

Modern cryptocurrency trading dashboard displaying buy/sell order books, intra-day price charts, and trade history with a clean dark-themed interface

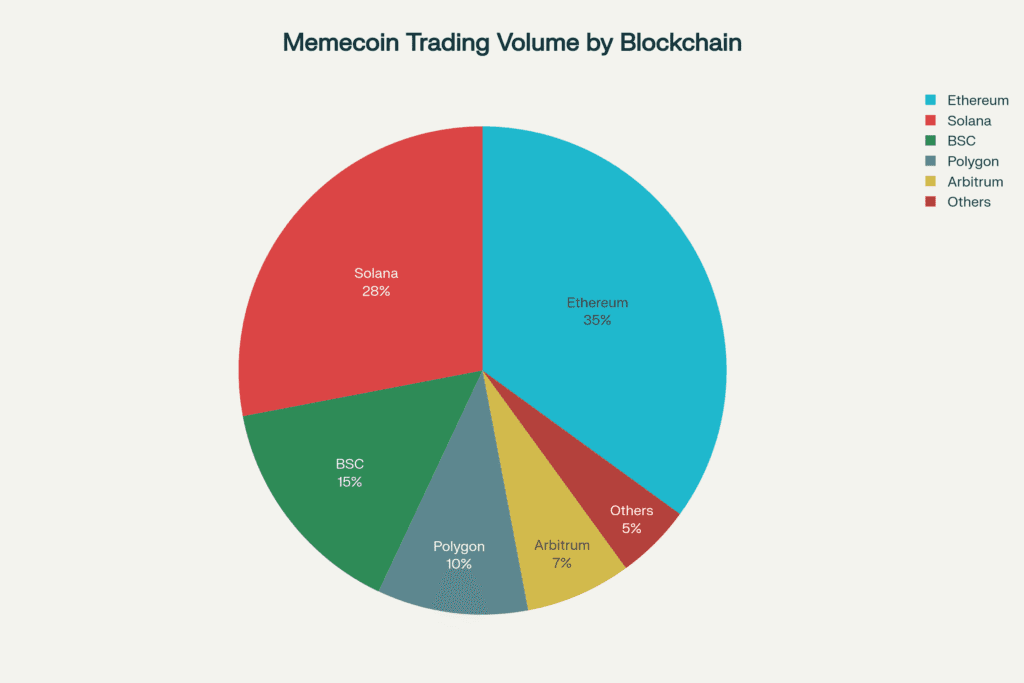

The current market landscape is incredibly diverse, spanning multiple blockchain ecosystems. Ethereum dominates with 35% of memecoin trading volume, while Solana captures 28%, creating opportunities across different chains. This multi-chain ecosystem means savvy investors can capitalize on various market conditions and find opportunities regardless of network congestion or gas fees.

Memecoin Trading Volume Distribution Across Major Blockchains

Key Market Drivers Making 2025 Exceptional:

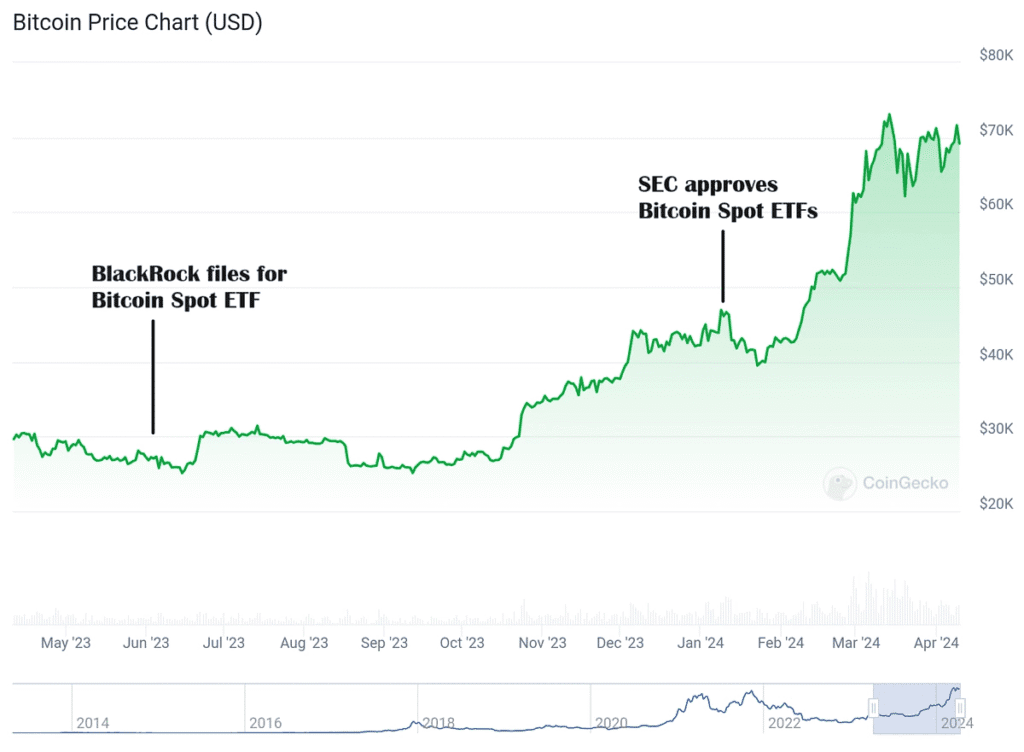

Bitcoin’s recent surge above $115,000 has triggered significant capital rotation into altcoins, with Bitcoin dominance falling from 66% to 57.2% in recent weeks. This shift typically signals the beginning of altcoin season, when memecoins historically deliver their most explosive performance. Additionally, the upcoming Federal Reserve rate cuts are creating a favorable macroeconomic environment for risk assets like memecoins.

The integration of artificial intelligence, NFTs, and gaming into memecoin ecosystems has created new utility beyond pure speculation. Projects now offer staking rewards, yield farming opportunities, and governance tokens, providing multiple income streams for holders. This evolution from meme to utility has attracted institutional attention and created more sustainable price appreciation.

Strategic Entry and Profit Maximization

Finding High-Potential Projects Early

The most substantial profits come from identifying promising memecoins before mainstream adoption. Focus on projects with market caps between $80,000 and $500,000, where legitimate price discovery occurs beyond initial launch speculation. Look for tokens that have survived their initial pump-and-dump phase and demonstrate sustained community interest.

Bitcoin price chart from May 2023 to April 2024 highlighting key events like BlackRock’s Bitcoin Spot ETF filing and SEC approval, showing a strong upward price trend

Essential Project Evaluation Criteria:

Active development teams with transparent roadmaps and regular community updates indicate long-term viability. Strong tokenomics featuring deflationary mechanisms, reasonable supply distributions, and clear unlock schedules help sustain price appreciation. Community engagement across Twitter, Discord, and Telegram should show organic growth rather than bot-driven activity.

Strategic partnerships with established projects, celebrity endorsements, or integration with popular platforms can trigger explosive growth. Monitor social sentiment using tools that track hashtag trends, influencer mentions, and user-generated content creation. Projects generating authentic memes and viral content often outperform those relying solely on paid marketing.

Chain Mascot Identification Strategy

Each blockchain ecosystem typically rallies around specific memecoin mascots that become cultural symbols. Ethereum has Dogecoin and Shiba Inu, while Solana features Bonk and other native tokens. Identify emerging blockchains without established mascots, as these present opportunities to invest in tokens that could fill this cultural void and benefit from ecosystem growth.

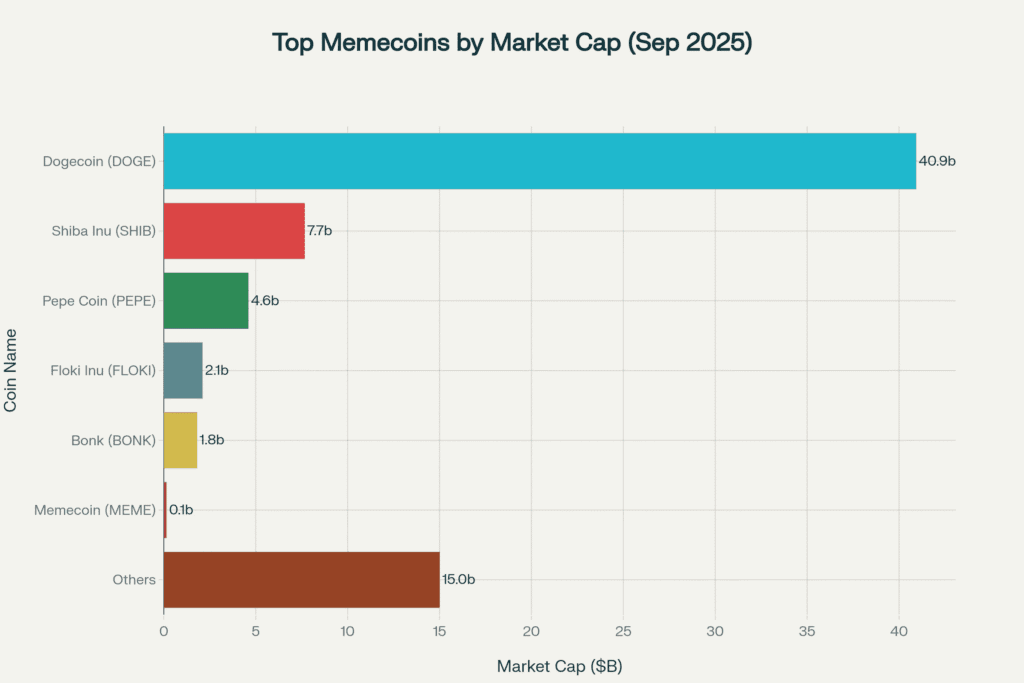

Leading Memecoins by Market Cap with Dogecoin Dominating at $40.9B

Advanced Trading Techniques

Implement systematic entry strategies using technical analysis combined with social sentiment monitoring. Use exponential moving averages to identify trend directions, with crossovers between short and long-term EMAs signaling potential entry points. Monitor relative strength index levels, adjusting traditional overbought (70) and oversold (30) thresholds wider for memecoin volatility.

Volume analysis is crucial for distinguishing genuine interest from artificial manipulation. Focus on coins showing increasing volume alongside price appreciation, indicating real demand rather than coordinated pumps. Fibonacci retracement levels help identify potential support and resistance zones during price corrections, providing strategic entry and exit points.

Risk Management and Portfolio Protection

Smart Position Sizing

Limit memecoin exposure to 1-5% of your total investment portfolio, allowing participation in explosive growth while protecting overall financial health. Start with smaller positions and scale up based on experience and market understanding. This conservative approach enables learning from mistakes without catastrophic losses.

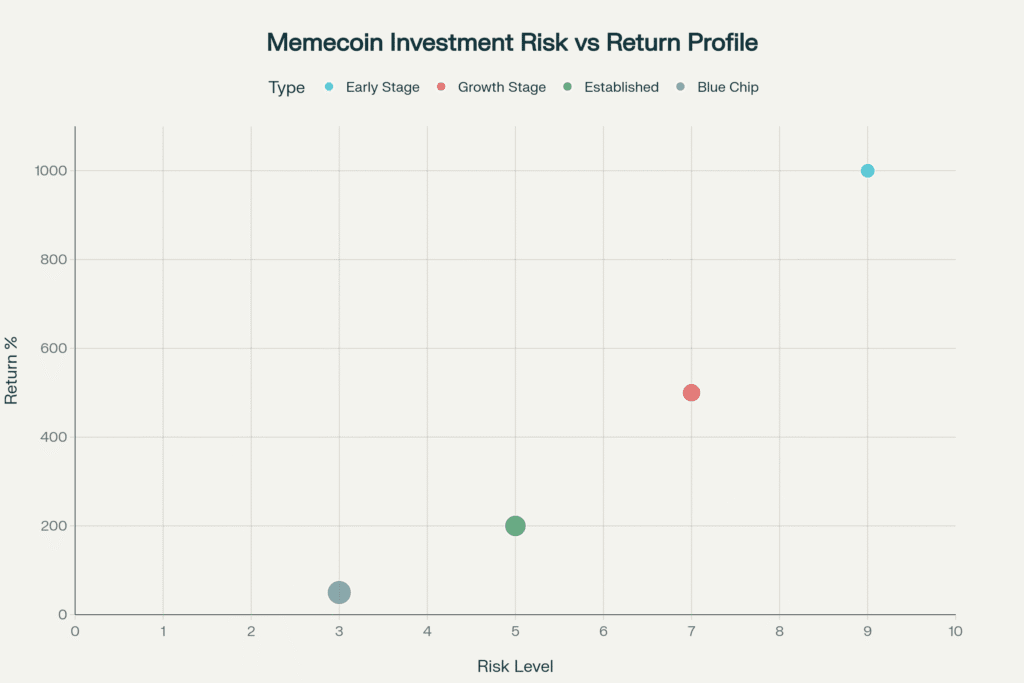

Risk-Return Analysis: Higher Risk Memecoins Offer Exponentially Higher Returns

Advanced Risk Management Framework

Implement systematic stop-loss orders 10-15% below entry points for established tokens, with wider margins for newer, volatile assets. Use trailing stops to lock in profits as prices rise while maintaining upside exposure. This mechanical approach removes emotion from selling decisions and protects against sudden reversals.

Diversification Strategies

Spread investments across multiple memecoins to reduce single-token risk. Diversify across different blockchain ecosystems, market cap ranges, and utility categories to minimize correlation risk. Consider mixing speculative early-stage plays with more established blue-chip memecoins for balanced risk-return profiles.

Portfolio Rebalancing

Regularly rebalance your memecoin portfolio based on performance and changing market conditions. Take profits from winners to fund new opportunities while maintaining target allocation percentages. Set predetermined profit-taking levels (25% at 2x, 25% at 5x gains) to systematically realize returns.

Security Best Practices

Protect investments through proper security measures including hardware wallet storage for long-term holdings and multi-signature wallets for large positions. Regular security audits of connected platforms and thorough scam identification techniques help avoid rug pulls and fraudulent projects that plague the memecoin space.

A modern hardware cryptocurrency wallet displaying popular cryptocurrencies and security features

DeFi Integration and Passive Income Generation

Staking and Yield Opportunities

Modern successful memecoins offer DeFi utility through staking mechanisms and liquidity provision rewards. ShibaSwap recorded over $1.5 billion in total value locked, demonstrating how memecoins generate passive income through staking rewards, liquidity pool participation earning trading fees, and yield farming programs with attractive APY rates.

DeFi earning opportunities outlined with six key categories including passive rewards, yield farming, liquidity, crypto assets, governance tokens, and DAOs

Advanced DeFi Strategies

Participate in governance token rewards for platform participation while earning additional returns. Many memecoin projects now offer DAO governance, allowing holders to influence project direction while earning governance tokens. Cross-platform yield farming across different protocols can maximize returns while spreading risk.

NFT and Gaming Integration

The intersection of memecoins with NFT marketplaces and gaming ecosystems creates additional utility and value accrual mechanisms. Projects integrating play-to-earn models, NFT collections, and cross-platform gaming utilities often demonstrate superior price stability and growth potential compared to pure speculation tokens.

Liquidity Provision Strategies

Providing liquidity to memecoin trading pairs on decentralized exchanges generates trading fees while supporting price stability. Choose pairs with high trading volume and reasonable impermanent loss risk. Monitor fee structures and incentive programs that can significantly boost returns beyond basic trading fees.

Decentralized finance explained with a network diagram illustrating the peer-to-peer connections and a clear definition emphasizing its use of secure distributed ledgers similar to cryptocurrencies

Future-Proofing Your Memecoin Strategy

The memecoin landscape continues evolving with emerging trends including AI integration for content generation and automated trading, Layer 2 solutions improving transaction costs and speed, and increasing regulatory compliance attracting institutional investment. Position yourself for these developments by focusing on projects demonstrating technical innovation, regulatory compliance, and institutional-grade governance structures.

Success in memecoin investing requires balancing aggressive growth opportunities with disciplined risk management. The market’s explosive growth trajectory, combined with improving infrastructure and institutional adoption, creates unprecedented opportunities for informed investors. By implementing the strategies outlined in this guide while maintaining strict risk controls, you can position yourself to profit from this dynamic and rapidly expanding market segment.

Remember that memecoin investing carries substantial risks, and you should never invest more than you can afford to lose. The intersection of internet culture and financial markets continues creating new opportunities for strategic investors who understand both the technical and cultural aspects driving memecoin success.